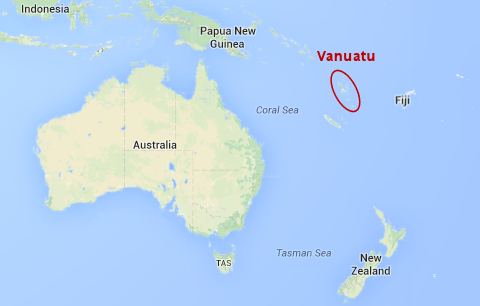

Vanuatu offshore incorporation is increasingly gaining in popularity and reputation. The jurisdiction is a popular global offshore financial center due its provision of many vehicles that limit the liability of the owners. These entities, combined with the ability to issue bearer shares held by a Vanuatu custodian, offer significant advantages for those seeking asset protection. Additionally, Vanuatu’s strict requirements regarding the disclosure of information to the public make it an ideal location for financial privacy. Vanuatu is an island nation located in the South Pacific Ocean, about three quarters of the way between Australia and Hawaii.

Vanuatu offers three main business entities. These are the sole trader, the partnership, and the company.

Sole Trader

Sole traders in Vanuatu are generally smaller businesses, such as shops or market stalls. Sole traders are personally liable for the debts and obligations incurred by their business. When a business is incorporated as a sole trader, there is no legal separation between the owner and the business.

Since sole traders have unlimited liability and no separate legal entity, they are less popular with foreign investors. Foreign investors tend to prefer to avail themselves of the limited liability offered by several of the various legal vehicles discussed below.

Partnerships

Partnerships in Vanuatu are formed by an agreement between two or more individuals. These individuals contribute financial assets, property, sweat equity, or a combination thereof to the business. Partnerships are popular amongst professionals in Vanuatu, such as lawyers and accountants. There are two different forms of partnerships in Vanuatu. These are the general partnership and the limited partnership.

General Partnership

General partnerships in Vanuatu are governed by the Partnership Regulation of 1975. This legislation is virtually identical to the English Partnership Act of 1880. The English Partnership Act of 1880 is the legislation most commonly used to govern partnerships in Commonwealth countries. As a result, the business environment in Vanuatu can feel very familiar to those hailing from Commonwealth nations.

General partners are jointly and severally liable for the debts and obligations of the partnership. They do not have to register or pay annual fees. Business partnerships, however, must have a license under the Business Licenses Act. They must also have a name which follows the guidelines set forth in the Business Names Act.

Limited Partnership

Limited partnerships in Vanuatu are also governed by the Partnership Regulation of 1975. In a limited partnership, there must be at least one general partner and at least one limited partner. There may not be more than 20 total partners in any one limited partnership.

General partners in a limited partnership and jointly and severally liable for the debts and obligations of the partnership. Limited partners in a limited partnership are only liable up to the amount of their contribution in the partnership.

Limited partnerships are required to register with the Registrar of Companies. They must also pay an annual registration fee.

Companies

The most popular business entity in Vanuatu is the company. In Vanuatu, companies are separate legal entities from their owners. The owners, known as shareholders, are not personally liable for the debts and obligations of the company. In the event that the company is wound up, the shareholders are liable only up to the amount that they invested into the company. Companies in Vanuatu have many of the same legal rights as individuals. They may own property, enter into contracts in their own name, sue, and be sued. There are four different types of companies available for incorporation in Vanuatu. These are the local limited company, the exempted company, the overseas company, and the international company.

Local Limited Company

Local limited companies in Vanuatu are companies which operate within Vanuatu’s borders. They may be limited by shares, limited by guarantee, or have unlimited liability. Local limited companies may be public or private.

Public local limited companies must have at least two directors. One of these directors is legally required to be a resident of Vanuatu.

Private companies must have at least one director who must be a resident of Vanuatu. Private companies in Vanuatu restrict the right to transfer shares. They may have no more than fifty shareholders. Private companies may not invite the public to subscribe to their shares.

All local limited companies in Vanuatu must have a secretary. They must hold annual meetings and file annual returns. Audited financial statements are required if the annual turnover of the company exceeds VT 20 million. Local limited companies are required by Vanuatu law to have a Memorandum and Articles of Association.

Exempted Company

Exempted companies in Vanuatu are companies formed under the Companies Act which may be exempted from public disclosure requirements. In order to qualify for the exemption, companies must not conduct business in Vanuatu other than international business. They also must not offer their shares for sale to the public in Vanuatu. Finally, they may not own an interest in any non-exempt companies which are operating in Vanuatu.

Exempted companies which operate in the banking, insurance, trustee, and securities sectors must file the same documents as local companies. They must also file audited annual accounts. Exempted companies operating in other sectors do not need to be audited or file annual accounts.

Records of exempted companies in Vanuatu are not available to the public. The Registrar’s Office is legally prohibited from revealing any documents regarding an exempted company. They may do so only if provided with a court order or with written authorization from the exempted company.

Exempted companies are the most popular form of incorporation in Vanuatu for offshore financial institutions. This is the case because international companies are prohibited from holding banking, trust, or insurance licenses.

International Company

For those not operating in the aforementioned financial sectors, international companies are the most popular legal vehicle for offshore incorporation in Vanuatu. International companies in Vanuatu are governed by the International Companies Act No. 32 of 1992. When this act was passed, most offshore companies elected to be international companies. In addition, a majority of exempted companies converted to international companies. International companies in Vanuatu are administered by the government.

As previously mentioned, international companies are prohibited from holding banking, trust, or insurance licenses in Vanuatu. They are also prohibited from selling their shares to the public in Vanuatu. Companies which undertake any of these activities are required by law to register under the Companies Act using a more suitable legal vehicle.

International companies do not require permit applications. As a result, it is usually possible to register an international company in Vanuatu in a single day. International companies in Vanuatu are not required to disclose details regarding their beneficial owners or operations.

In order to register an international company, a constitution for the company must be filed with the Vanuatu Financial Services Commission. The constitution must contain the company’s name. its general purposes, its registered office and agent, and whether it is limited by shares or guarantee.

International companies in Vanuatu have no minimum capital requirement. The capital used to start the company may be in any currency. International companies may issue registered shares or bearer shares. The shares may be par value or no-par value. The shares may have full, partial, or no voting rights. They may be convertible, common, preferential, or redeemable.

International companies in Vanuatu are required to have a minimum of one shareholder who can be a nominee. They must also have one director. Corporate directors are permitted by Vanuatu law. Corporate secretaries are not required from international companies. They are permitted, however, and are not required to be located in Vanuatu.

International companies in Vanuatu are not required to keep or file accounts. They are also not required to file annual returns. Vanuatu does not have any requirements regarding holding annual meetings.

International companies are not permitted to conduct business within the borders of Vanuatu. They are also not permitted to hold an interest in real estate in Vanuatu. The is one exception to this rule. It is that international companies have the ability to lease the premises from which it conducts international business. International companies are also not permitted to solicit the public to deposit with or lend money to the company.

Vanuatu law imposes a solvency test on all international companies. Directors of international companies are responsible for ensuring that the company is able to meet its liabilities after any distributions. Directors can be held personally liable if an international company is found to have failed the solvency test before making a distribution

Overseas Company

Overseas companies are companies which have previously been incorporated in a foreign jurisdiction. These companies re-register in Vanuatu under the Companies Act. Overseas companies are required by law to appoint two Vanuatu residents who may accept notices on their behalf. They are required to file annual returns along with audited accounts and payment of an annual fee.

Foreign companies may migrate to Vanuatu by way of continuation if this is not forbidden by the laws of the company’s home country. International business companies from other jurisdictions also have this option. Additionally, the reverse process is also possible.