Beautiful Beaches, Untouchable Assets

The Cook Islands provide some of the world’s best legal vehicles for asset protection in an idyllic island paradise. Known as an offshore tax haven, favorable laws regarding taxation and financial privacy make the Cook Islands an excellent choice for offshore incorporation.

Cook Islands Asset Protection and Vehicles for Business

Cook Islands Companies

The following methods can be utilized in the Cook Islands for the purpose of asset protection:

Cook Islands LLC

The Cook Islands Limited Liability Company (LLC) is the most popular type of company formed in the jurisdiction today. A single member, single manager LLC is acceptable. There is no upper limit to the number of members. Managers can participate free from company liability or debts that may normally happen during the course of business. Someone who is not a member can be a manager of a Cook Islands LLC.

If someone sues an LLC member, personally and wins, that creditor cannot take the company nor the assets inside. The sole remedy is a charging order. That is, the creditor can take funds paid from the company to that member. But the creditor has to right to force the payment from the company to the member. Moreover, such a charging order falls off after five years and is not renewable.

International Business Company

Until the advent of the LLC, International Business Companies were the most popular legal vehicles for offshore incorporation in the Cook Islands. The International Companies Act of 1981-1982, which was amended in 2006-2007 according to the International Companies Amendment Act, sets forth the following provisions for offshore incorporation:

- Residents of the Cook Islands are prohibited from holding a beneficial interest in a Cook Islands International Company.

- Unless they operate in the banking or insurance sectors, International Companies do not require a business license to operate in the Cook Islands.

- International Companies must file annual returns.

- The company’s books, seal, and records regarding shareholders, the company secretary, and charges are required to be maintained in the company’s registered office.

- Bearer shares can be issued.

- Bearer debentures can be issued.

- There is no minimum share capital requirement.

- No par value shares are permitted.

- A court order is not required for an International Company to purchase some or all of its own shares.

- A court order is not required for an International Company to reduce its own share capital.

- An International Company is only required to have one shareholder.

- In the Cook Islands, an International Company is only required to have one director who can be corporate or non-resident.

- Cook Islands law mandates that the secretary of an International Company must be a trust company registered in the Cook Islands

- Unless an International Company holds and offshore banking or insurance license, accounts are not required to be filed or audited.

- Stamp duties are not levied on corporate documents.

- Annual general meetings are not required.

- Foreign companies may be re-domiciled in the Cook Islands.

- It is possible for domestic companies to move their operations to other jurisdictions and become re-classified as International Companies.

- The membership interest of any shareholder may be automatically vested in an appointed person upon the occurrence of a specific event, such as death or bankruptcy, as long as the articles of association stipulate the International Company’s ability to do so.

- An International Company can be incorporated using a foreign name

- Shares of an International Company can be issued in foreign currencies.

- There is no legal requirement to file shareholder information for International Companies.

Domestic Limited Company

The Cook Islands refers to companies which trade locally or have local shareholders as Domestic Companies. Under the Development Investment Act of 1976, all domestic companies must obtain a business license which requires the payment of an annual fee. There are two types of Domestic Limited Companies: resident and non-resident. Resident Domestic Limited Companies pay 20% corporate tax. Non-resident Domestic Companies pay 28% corporate tax. There is no capital gains tax, however. Interest, dividends, and royalties are subject to 15% withholding tax. VAT is valued at 12.5% on most goods and services.

Registered Listed Company

Registered Listed Companies are foreign companies which have re-registered in the Cook Islands as International Companies following being listed on an approved and recognized stock exchange. The records of a Registered Listed Company are required to be made available for public inspection. The company’s records are also subject to inspection by the Monetary Board. Registered Listed Companies do not enjoy the same freedom as other International Companies to buy back and reduce their share capital. Registered Listed Companies require a court order to reduce their share capital.

Foreign Company

A Foreign Company is a company which was incorporated in a foreign jurisdiction and has re-registered in the Cook Islands as an International Company. Foreign Companies are not publicly listed companies. Unless a foreign company is only conducting a one-time transaction which will be completed in less than 31 days, they are required to re-register in the Cook Islands. Foreign companies may establish a physical location in the Cook Islands. Foreign Companies are not required to obtain a business license.

Limited Partnership

Limited partnerships have the ability to be formed in the Cook Islands under the International Partnerships Act of 1984. Partnerships must be formed as limited liability partnerships or unlimited liability. One of the partners is required to have unlimited liability in a limited liability partnership. International Partnerships must have one resident partner. This partner can be a resident licensed trustee company. It can also be an International Company formed under the International Companies Act which is registered in the Cook Islands. The remainder of the partners in a Limited Partnership are required to be non-residents.

Cook Islands Trusts

Cook Islands trust law seems as though it created with the intention of attracting business from America. This is likely because it was amended by an American in 1989. According to The New York Times, Cook Islands officials hired a Denver lawyer to write the nation’s trust laws after reading in The Economist about his work regarding asset protection trusts. Known locally as International Trusts, trusts in the Cook Islands are governed by the following provisions of the International Trusts Act of 1984:

- International trusts in the Cook Islands are required to have non-resident beneficiaries.

- They are required to have a resident licensed trustee, though this person may be a custodian for an executive trustee located overseas.

- The local trustee must register the trust within 35 days of its creation.

- The local trustee must certify that the trust is an International Trust under the International Trusts Act of 1984.

- There is no perpetuity period rule in the Cook Islands.

- There is no rule against accumulations.

- There is no rule against purpose trusts.

- Dispositions can be set aside in certain circumstances.

- Majority decisions can be made by trustees.

- Trusts can be re-domiciled in the Cook Islands.

Benefits of Cook Islands Incorporation

Cook Island laws are extremely favorable for those seeking to protect their assets. The following benefits can be availed by those who choose to incorporate in the Cook Islands:

Financial Privacy

The Cook Islands does not keep a public registry of international companies. In order for a person to obtain information about a company located in the Cook Islands, they must contact the company itself. The Registrar of the Cook Islands keeps only the names and addresses of a company’s directors on file. Records regarding shareholders are required to be maintained only at the registered office of the international company. The Cook Islands imposes severe penalties on those who breach its confidentiality laws. Rights to be privacy can, however, be waived in instances of severe criminal misconduct.

Tax Exemption

International companies in the Cook Islands are exempted from taxation. Though US people are taxed on worldwide income.

Protection from Foreign Judgements

The Cook Islands generally does not recognize foreign judgements, nor does it enforce them. Creditors are required to travel to the Cook Islands to have their cases adjudicated in a Cook Islands court. The exception to this rule is judgements issued from New Zealand courts, as the Cook Islands is engaged in a compact of free association with New Zealand.

Expediency

The Cook Islands incorporation process is streamlined and can be completed in as little as three days.

Low Shareholder Minimum

Cook Islands law requires only one shareholder and one director for incorporation.

No Authorized Capital Minimum

There is no minimum share capital requirement for incorporation in the Cook Islands.

Low Renewal Fee

The annual renewal fee for incorporation in the Cook Islands is only US$ 300. This is far lower than many other jurisdictions commonly used for offshore incorporation.

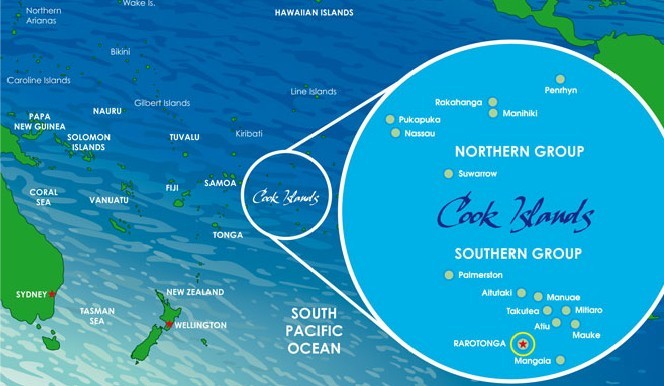

Cook Islands Background

Located in the South Pacific Ocean between Hawaii and New Zealand, the Cook Islands derive their name from Captain Cook, who sighted them in 1770. The Cook Islands became a British protectorate in 1888. In 1900, administrative control of the islands was transferred to New Zealand. The Cook Islands have been self-governed since 1965. They still enjoy a free association with New Zealand. Emigration of skilled workers from the Cook Islands to New Zealand is very common.

The Cook Islands have a GDP of roughly US$ 300 million. Tourism is the largest sector in the Cook Islands as a result of its beautiful beaches, temperate weather, and rich local culture. The islands received 14,301 visitors in 2017. International business and trusts account for roughly 8% of the Cook Islands GDP, making them the largest contributor after tourism. Fishing is the next largest sector following international business. Black pearls are the largest export of the Cook Islands. The Cook Islands have an Exclusive Economic Zone (EEZ) which is attractive to investors.

The total land area of the Cook Islands is approximately 92 square miles or 240 square kilometers. Comprised of 15 different islands, the Cook Islands have a population of only 9,290. Most of the Cook Islands population is found on the island of Rarotonga. English and Cook Islands Maori (Rarotongan) are the official languages.